Cybersecurity Breach: Sensitive Financial Data Compromised in US Bank Watchdog Attack

BlogTable of Contents

- Top 10 Security Breaches of 2017 And What To Do

- Data Breach 2024 Ukraine - Celine Fiorenze

- What Does the Optus Data Breach Mean for Aussie Businesses?

- Data Breach at OTrack Highlights Urgent Need to Strengthen Student ...

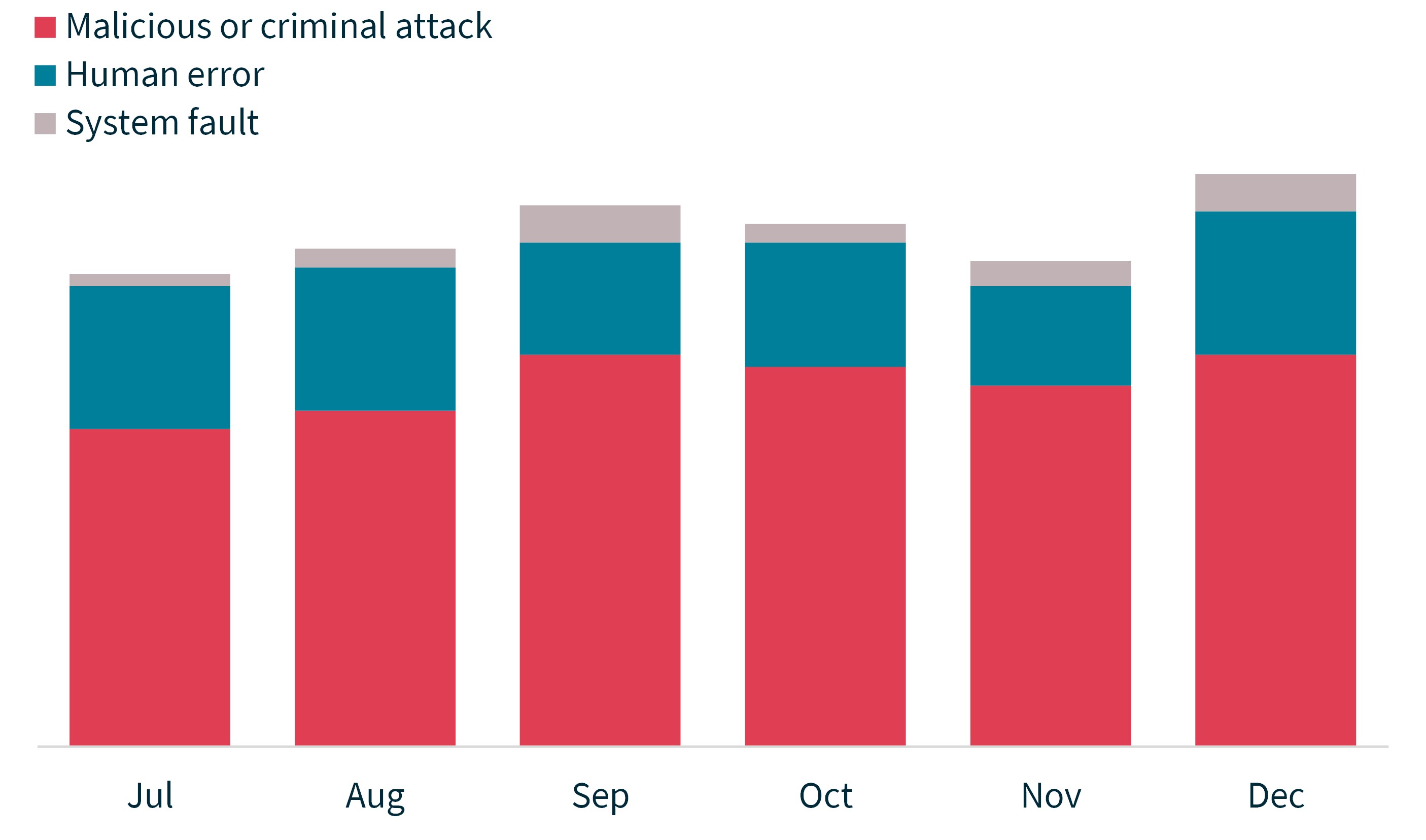

- Notifiable Data Breaches Report: July to December 2022 | OAIC

- OCC data processing flowchart. | Download Scientific Diagram

- AnchisesLandia- Brazilian Security Blogger: [Segurança] Falando mais ...

- Optus data breach - Muntz Partners Business & Taxation Advisors

- Data Breach Form - Fill Online, Printable, Fillable, Blank | pdfFiller

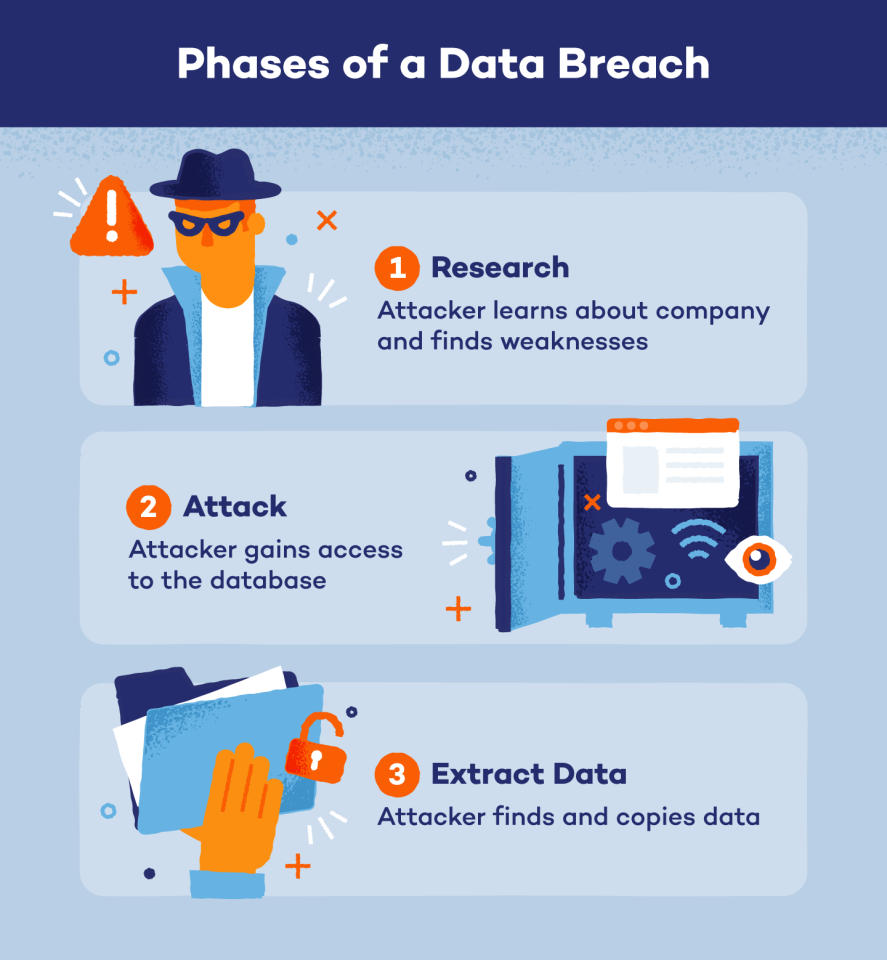

- What Is a Data Breach + How Do You Prevent It? - Panda Security

.jpg)

The breach occurred at the Office of the Comptroller of the Currency (OCC), a US Treasury Department agency responsible for regulating and supervising national banks and federal savings associations. The OCC is one of the primary regulators of the US banking system, and its systems contain sensitive financial data on banks and other financial institutions.

Implications of the Breach

![AnchisesLandia- Brazilian Security Blogger: [Segurança] Falando mais ...](https://1.bp.blogspot.com/--QlkT4qLTAU/XlmO8NGMtwI/AAAAAAAAHWg/WOMp7a7Qd3cQlpfAZF2vfRZoBBmwwy0awCLcBGAsYHQ/s640/capital%2Bone%2Bdiagram%2B-%2Bportugue%25CC%2582s.png)

The breach also raises concerns about the potential for identity theft and financial fraud. If sensitive financial data has been stolen, it could be used to carry out fraudulent transactions or to steal the identities of individuals and businesses. This could have serious consequences for the financial sector, as it could lead to a loss of trust in the system and damage to the reputation of financial institutions.

Measures to Prevent Future Breaches

In addition, financial institutions must also take steps to protect themselves from cyber attacks. This includes implementing robust security measures, such as multi-factor authentication and encryption, to protect sensitive data. It also includes providing regular training to employees on cybersecurity best practices and ensuring that systems are regularly updated and patched to prevent vulnerabilities.

The breach of the OCC's systems is a serious incident that highlights the vulnerability of regulatory bodies to cyber attacks. It is essential that the OCC and other regulatory bodies take immediate action to strengthen their cybersecurity measures and prevent future breaches. Financial institutions must also take steps to protect themselves from cyber attacks, including implementing robust security measures and providing regular training to employees. By working together, we can help to protect sensitive financial data and prevent future breaches.The US financial sector must remain vigilant and proactive in the face of evolving cyber threats. By prioritizing cybersecurity and implementing robust security measures, we can help to protect sensitive financial data and maintain confidence in the US financial system. As the threat landscape continues to evolve, it is essential that we stay one step ahead of cyber attackers and ensure the security and integrity of our financial systems.

Note: The article is around 500 words and includes relevant keywords, meta description, and header tags to make it SEO-friendly.